Spectacular Info About Present Value Of Annuity Excel Template

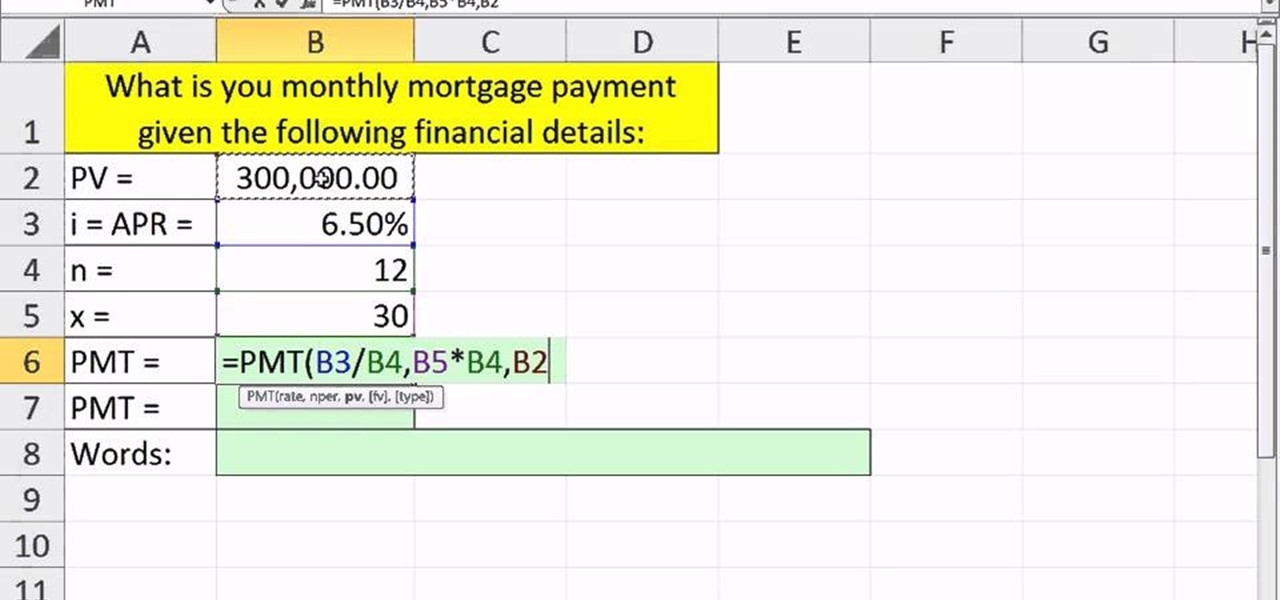

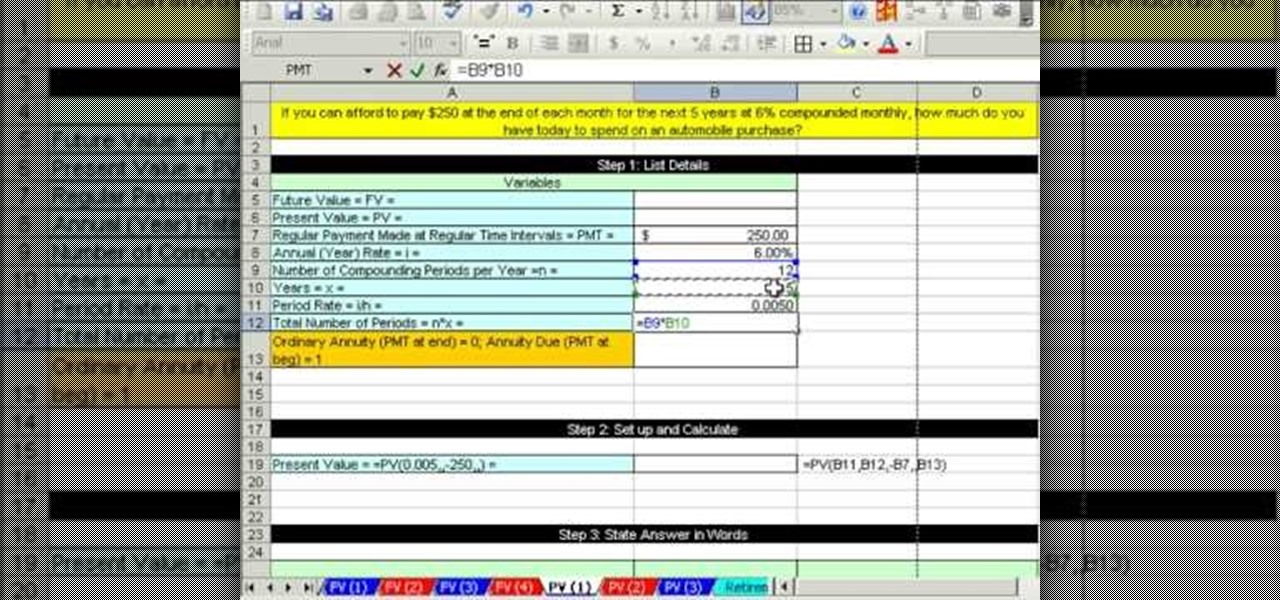

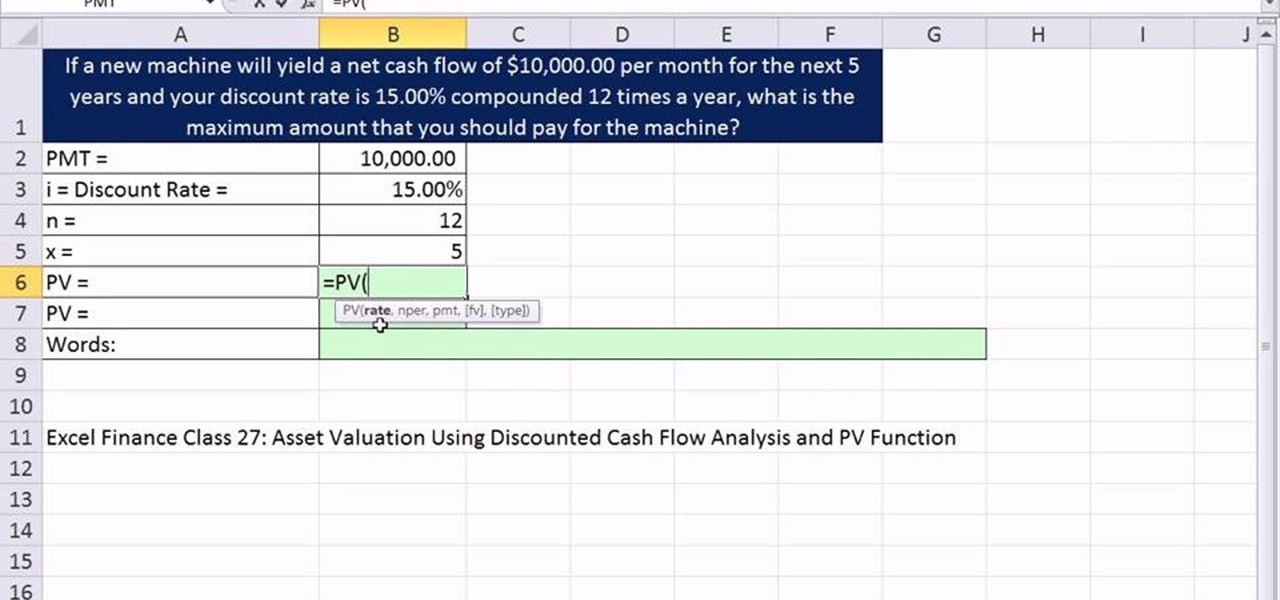

In excel, the present value function, specifically known as the pv function, is a.

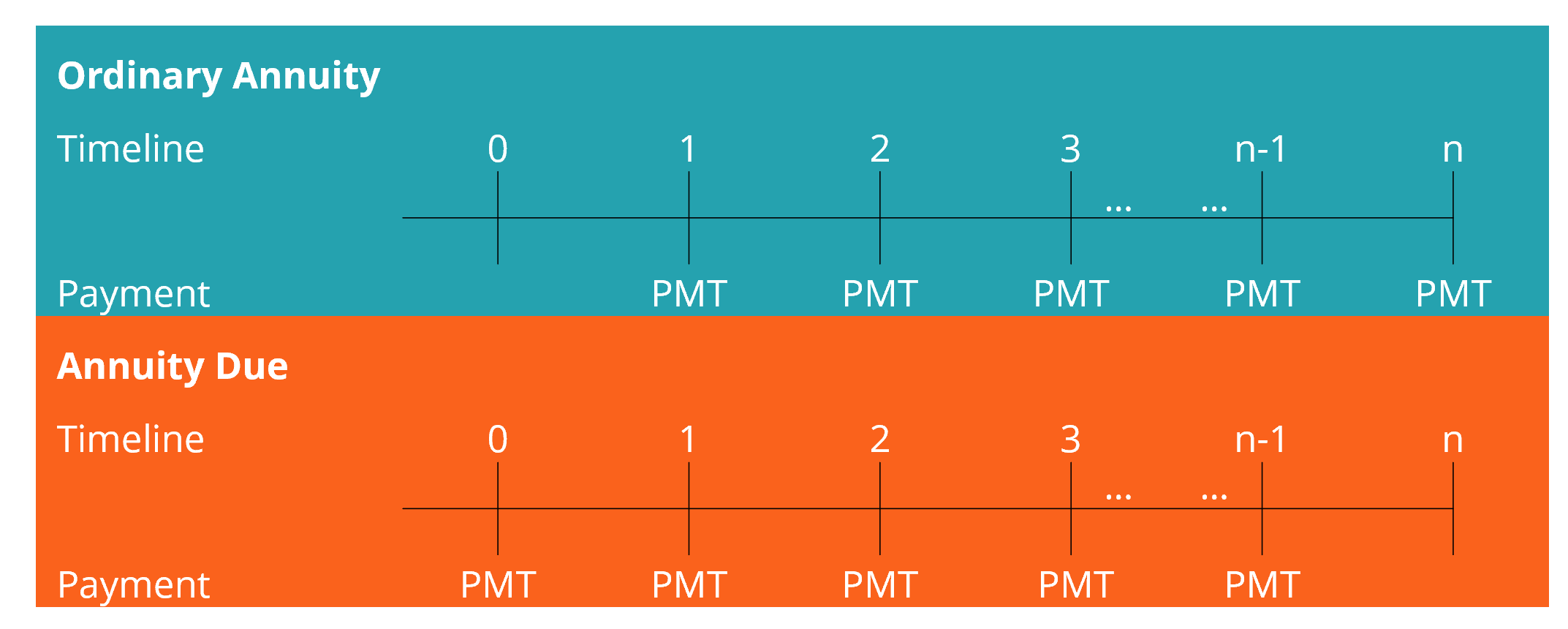

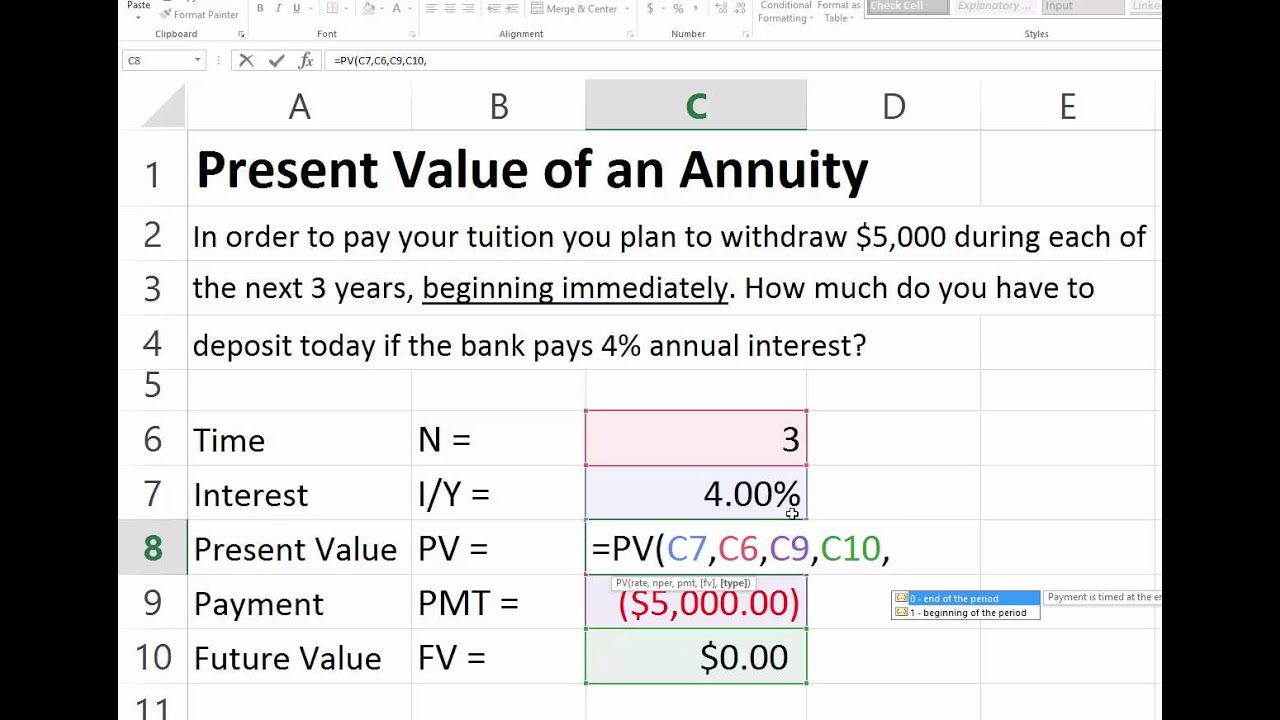

Present value of annuity excel template. What is a present value of annuity table? A present value of annuity table shows you how much future payments are worth right now. The only difference is type = 1.

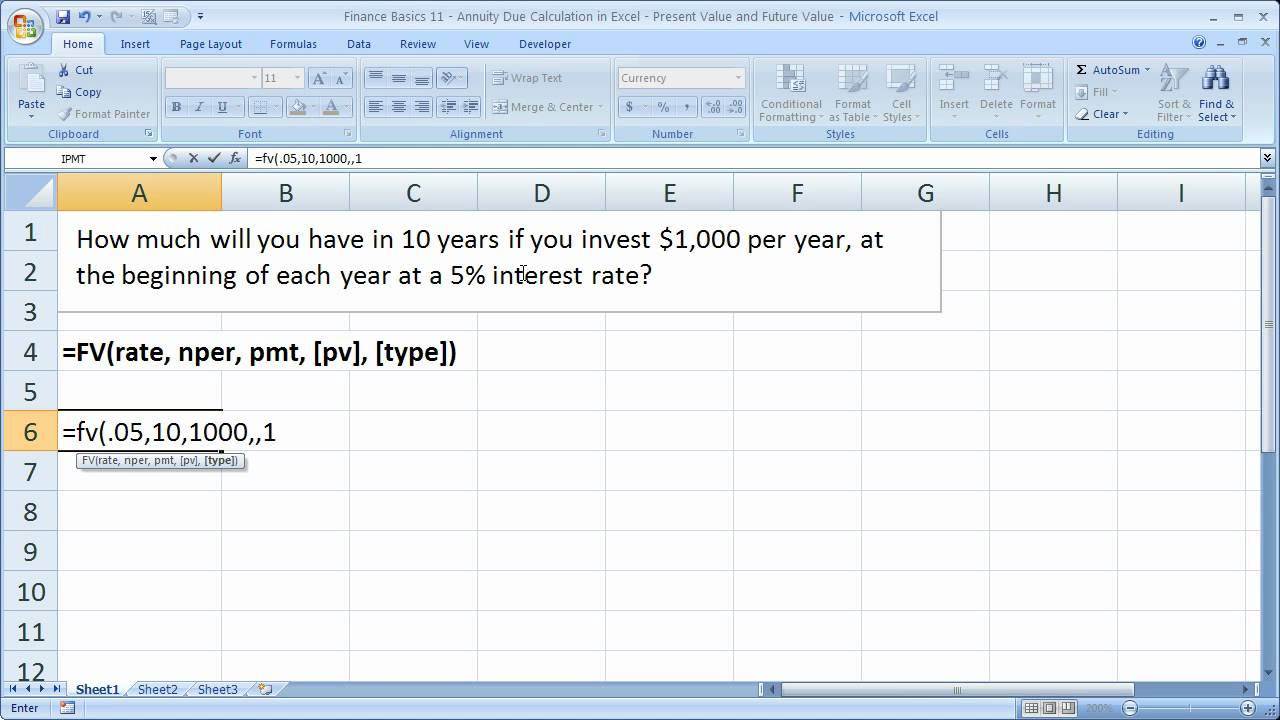

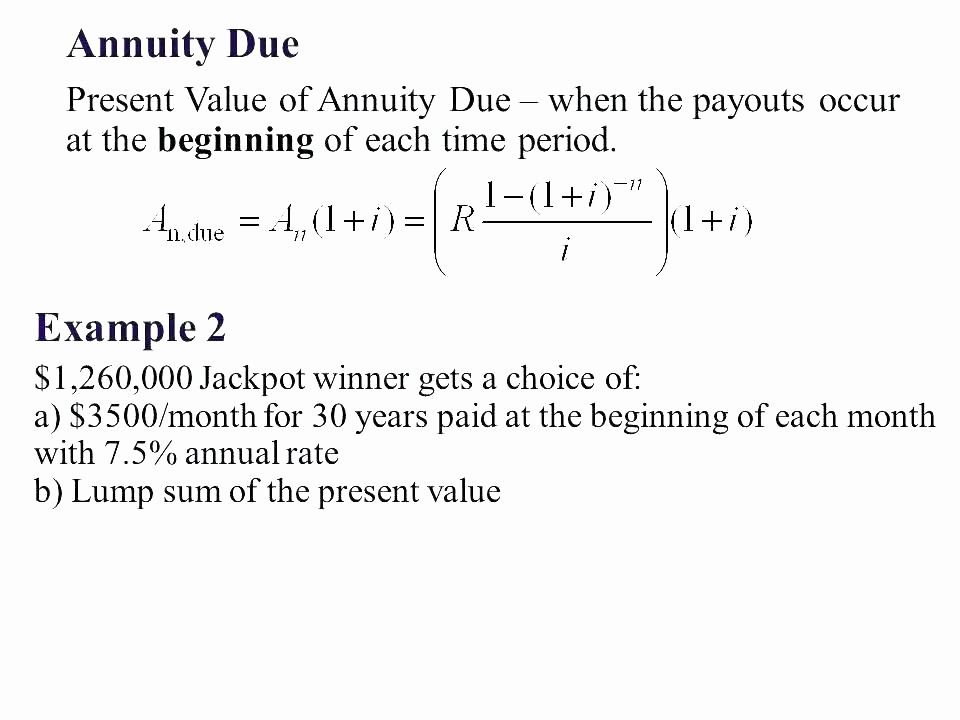

In simple terms, present value of annuity is the current value of a series of equal payments to be made or received in the future. With an annuity due, payments are made at the beginning of the period, instead of the end. The formula for calculating pv in excel is =pv (rate, nper, pmt, [fv], [type]).

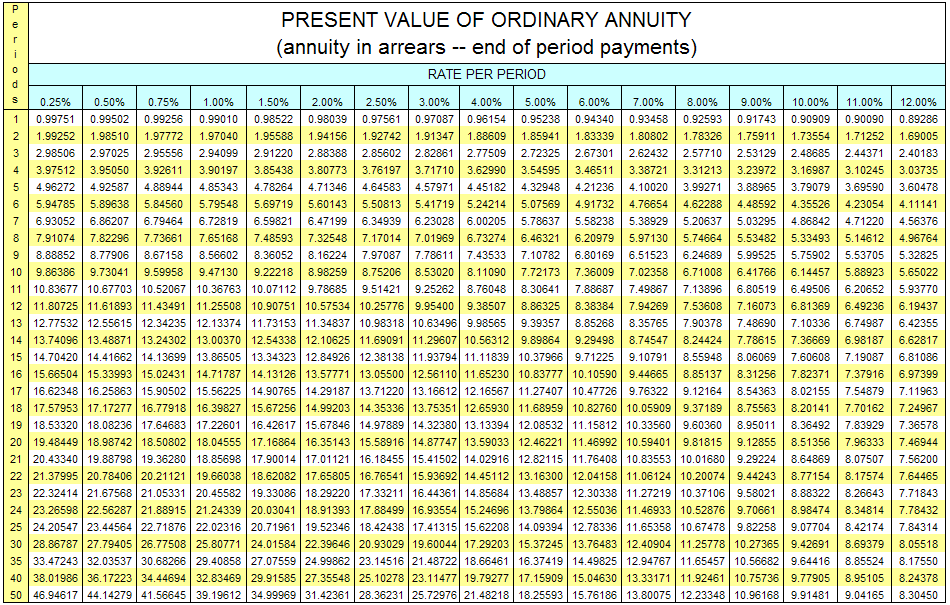

Related formulas future value of annuity see more Why would i use a. These are periodic annuity, number of periods, interest rate,.

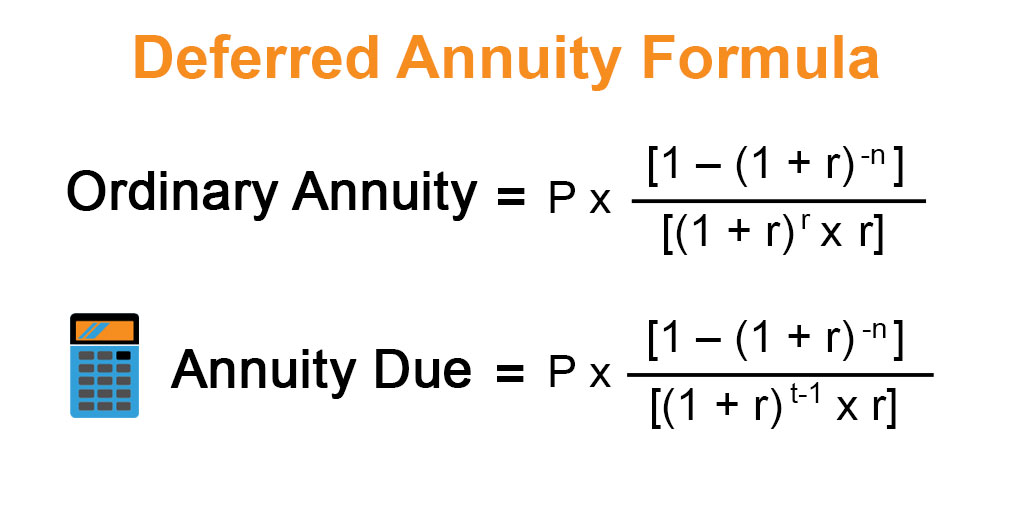

But what exactly is it? The formula to calculate present value of annuity due is as below:

Formula and how to calculate what is the present value function in excel? The present value calculator displays a present value loss of $1,102.75, the difference between $8,897.25 and the $10,000 investment. To calculate present value for an annuity due, use 1 for the type argument.

Present value can be calculated relatively quickly using microsoft excel. The present value of $10,630.72, as. In the example shown, the formula in f9 is:

Here, we will find out both ordinary annuity and. In the following examples, we will be mainly working with 4 parameters to calculate annuity in excel. This function represents the present value of an annuity, loan or investment based on a constant interest rate.

You can use the template to calculate the future value of your investment, deposit, and obligation. It helps in determining the.