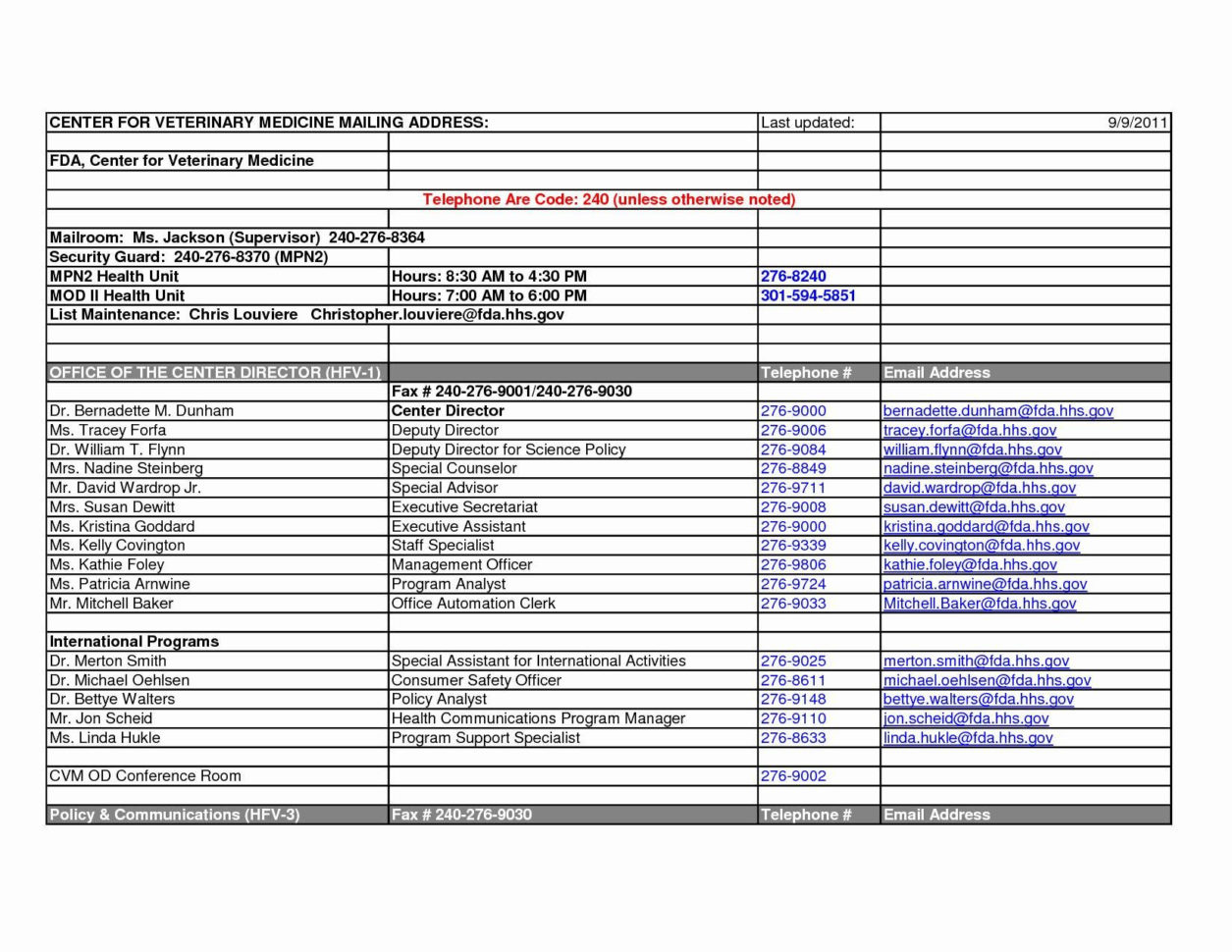

The Secret Of Info About Npv Excel Spreadsheet Template

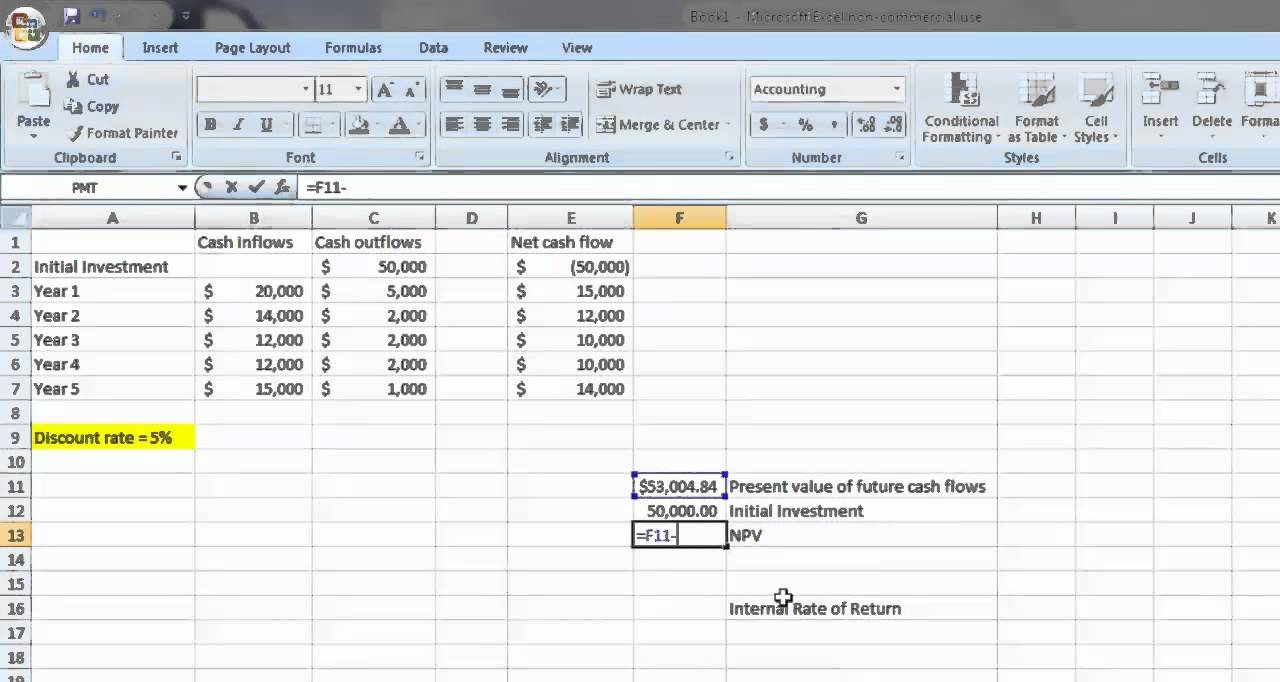

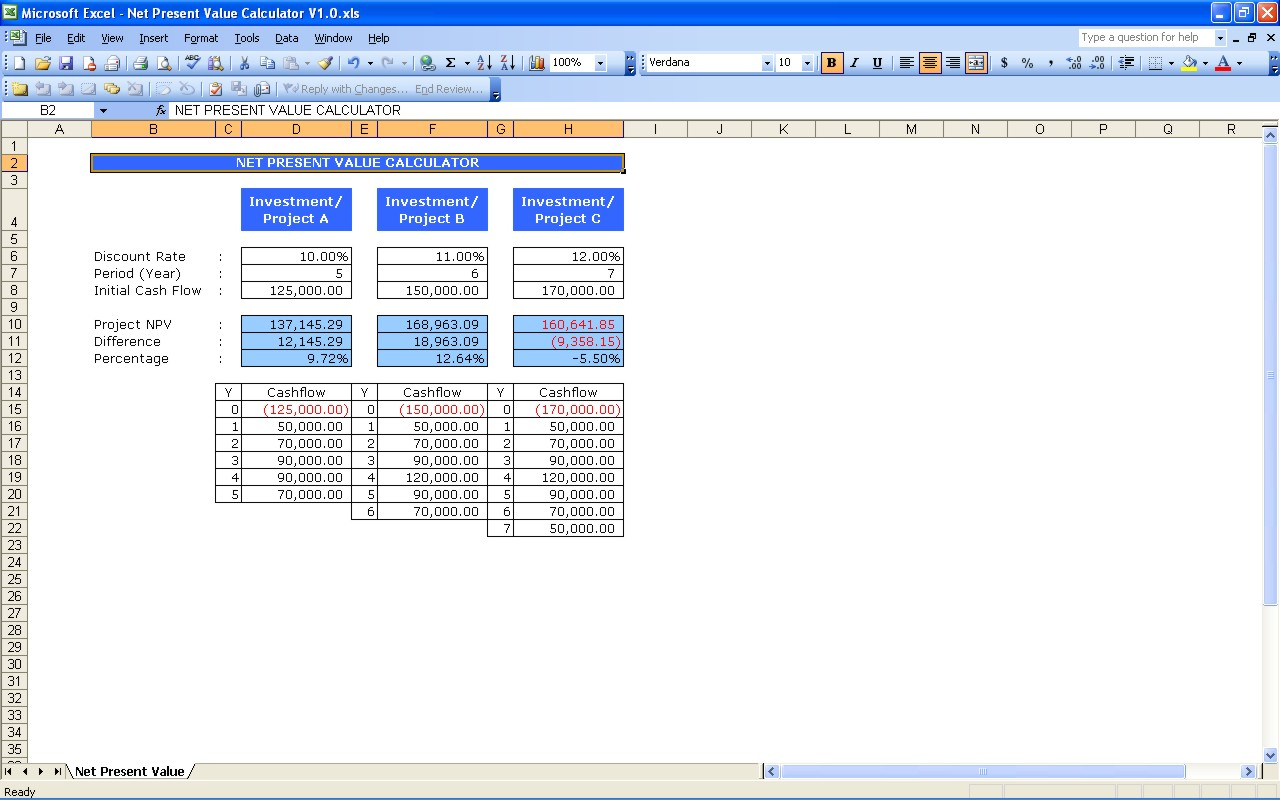

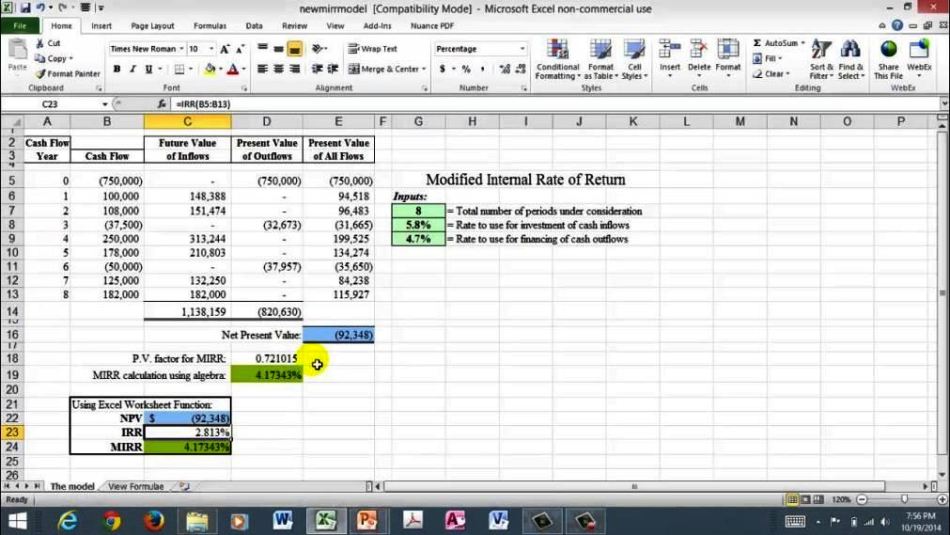

Here is a screenshot of the net present value.

Npv excel spreadsheet template. This article is a guide to npv function in excel. This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. =pv (rate, nper, pmt, [fv], [type]) in summary, while pv is a calculation for a single future cash flow, npv involves summing the pvs of multiple.

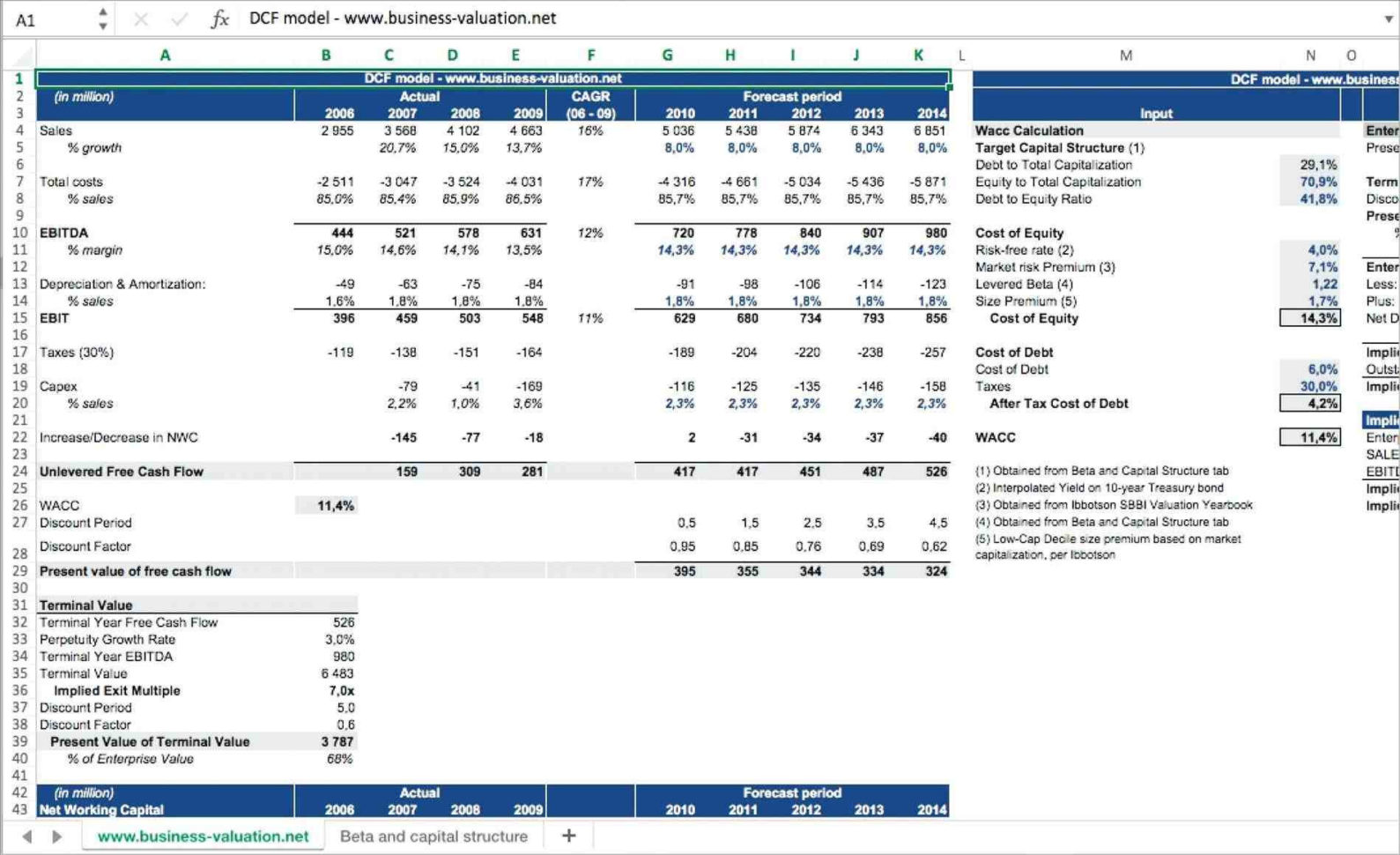

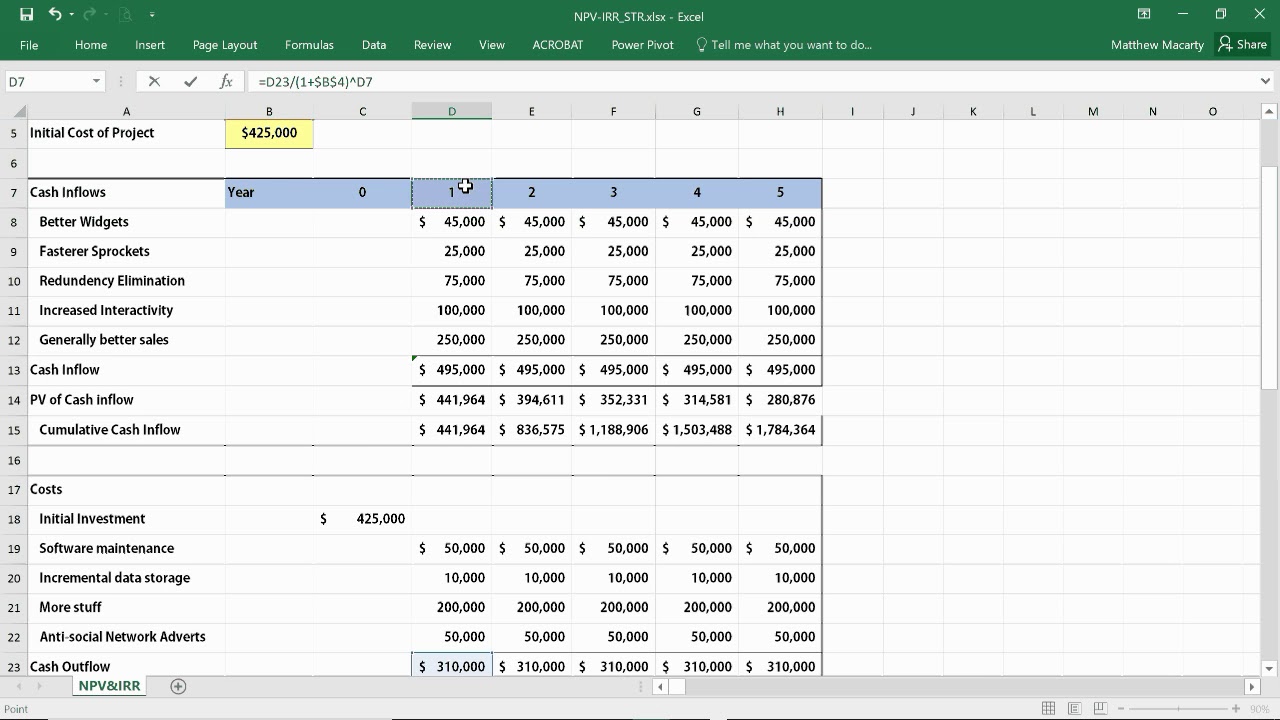

We discuss the npv formula in excel and how to use npv in excel, along with practical examples and downloadable excel. + cfn / (1 + r)^n. Excel pv formula:

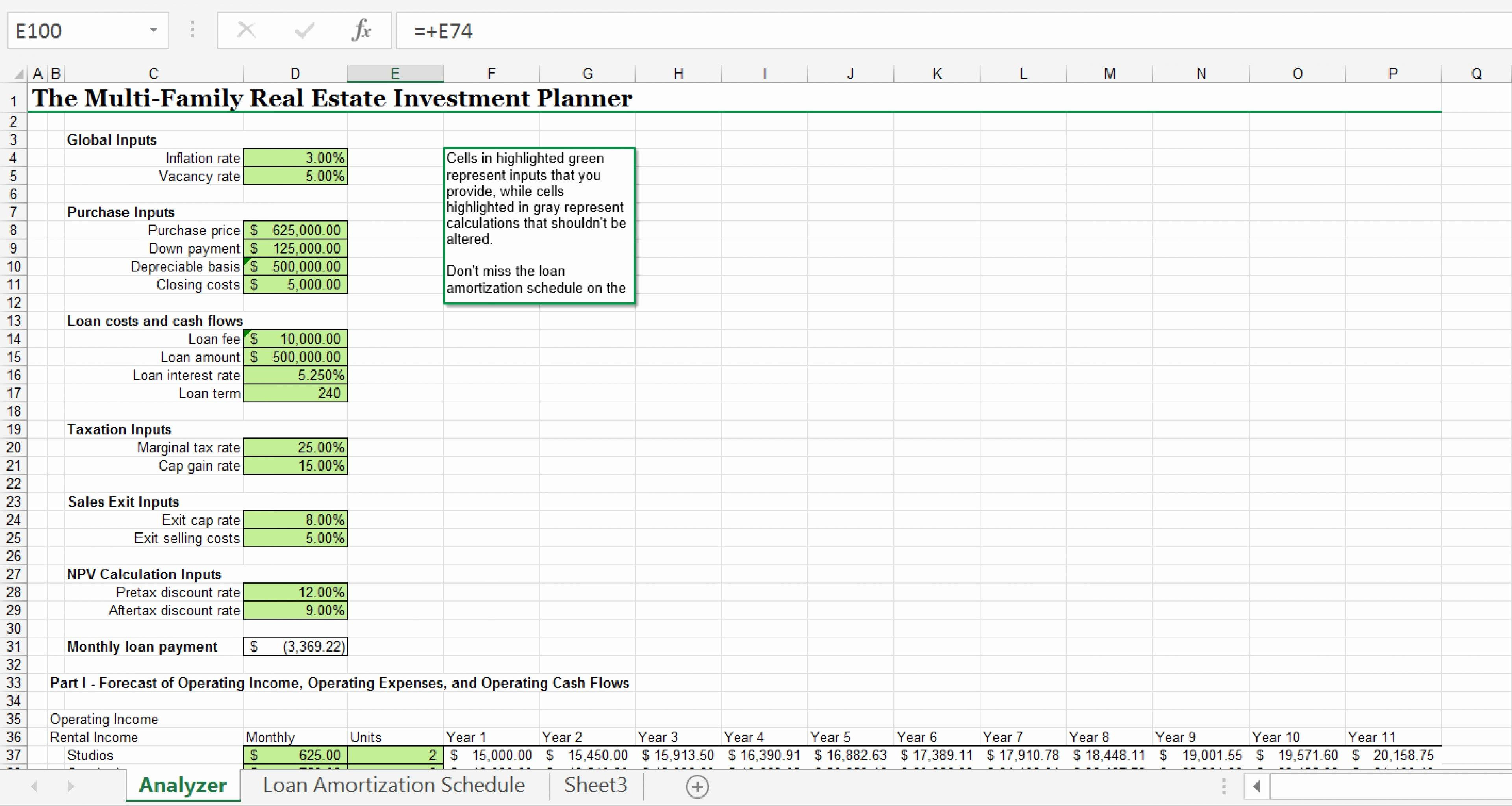

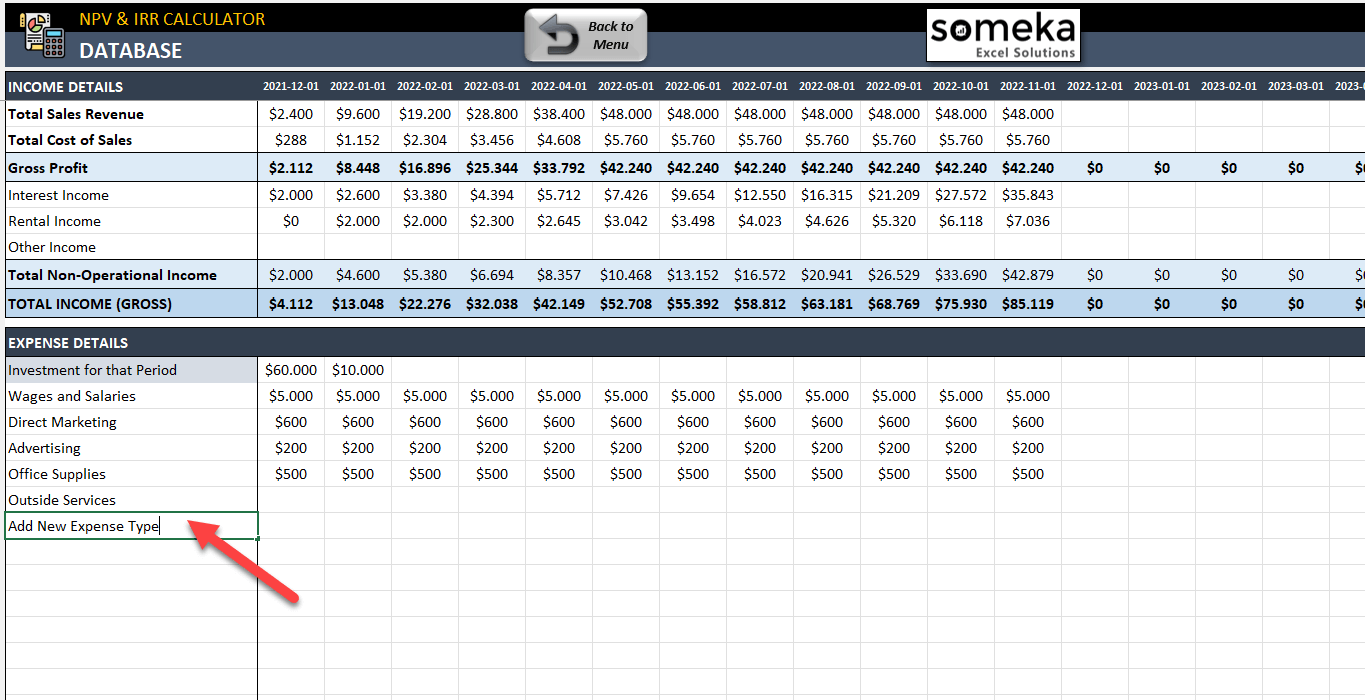

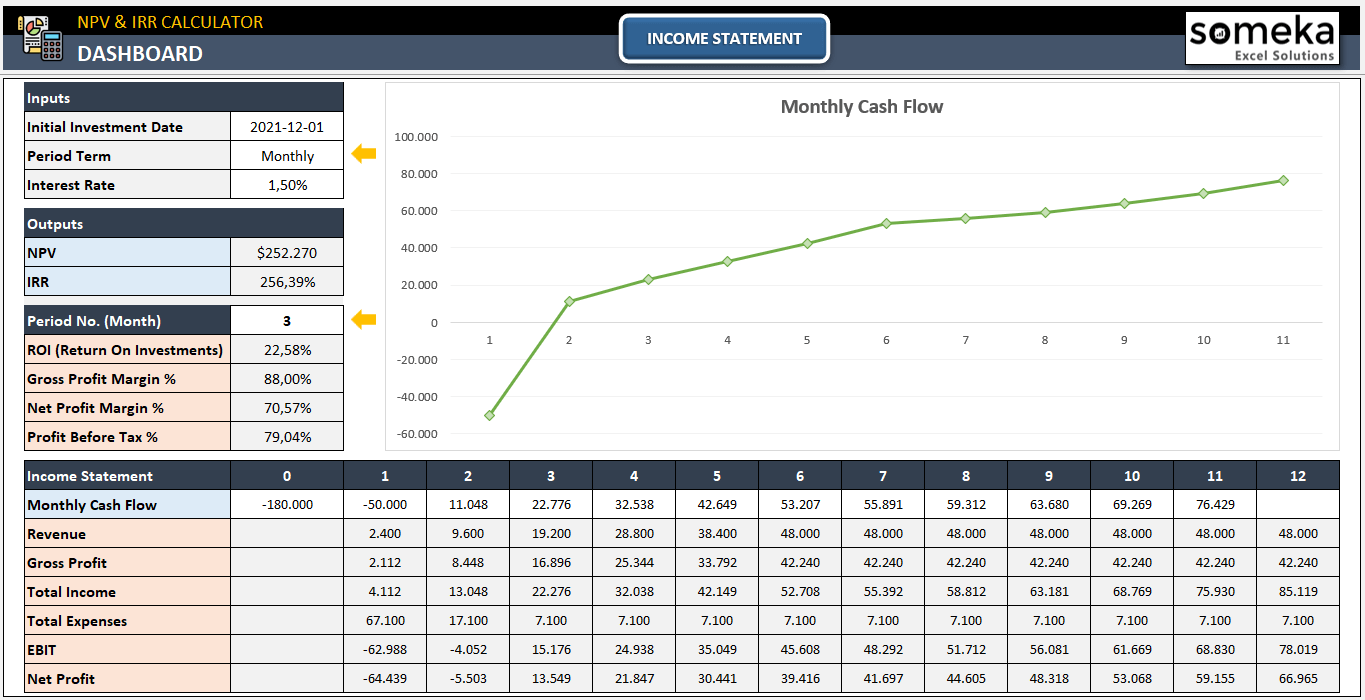

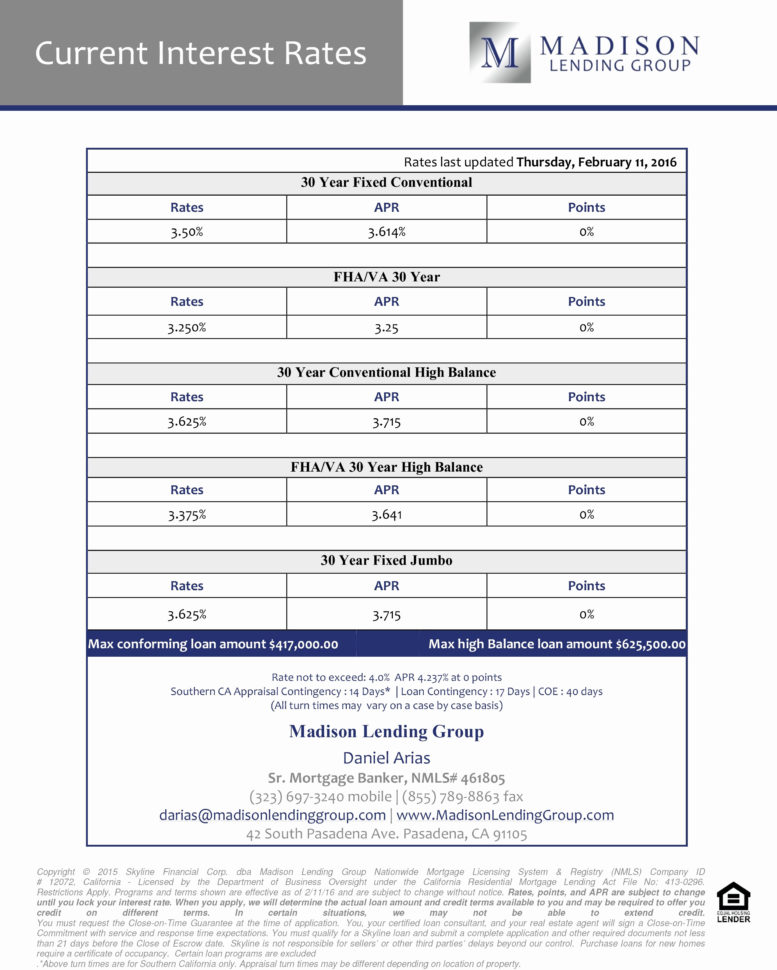

Npv calculator with irr, xnpv, and xirr for excel, google sheets and openoffice. Analyze your results with this free excel net present value npv calculator. The discount rate is the rate for one period,.

The npv calculator spreadsheet includes the irr calculation as well. Npv = cf1 / (1 + r)^1 + cf2 / (1 + r)^2 + cf3 / (1 + r)^3. Download this template for free get support for this template table of content in financial, there are some standard value measurement that usually used to measure whether a.

Npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows. The npv function [1] is an excel financial function that will calculate the net present value (npv) for a series of cash flows and a given discount rate. Net present value calculator find the net present value (npv) of an investment with an npv calculator.

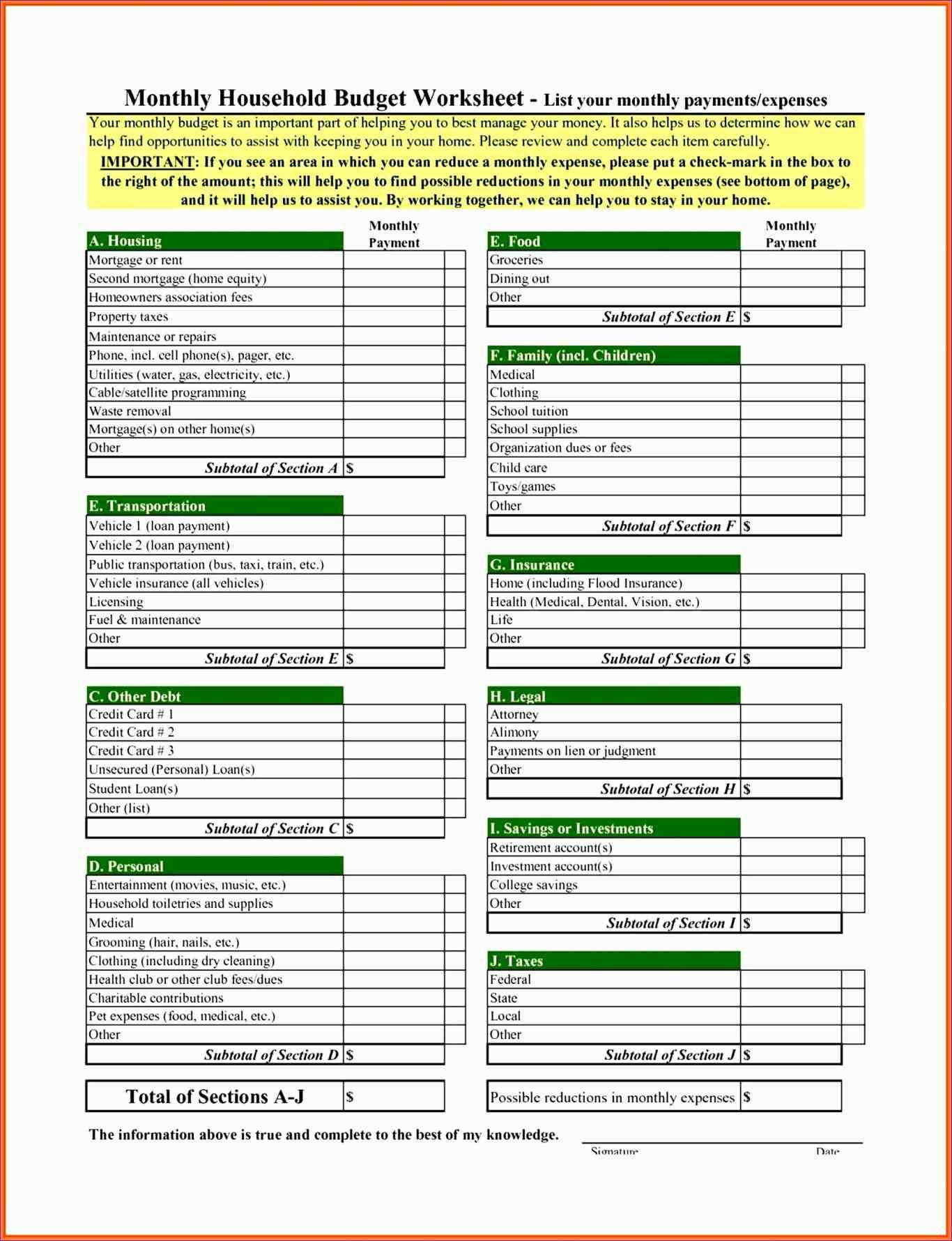

Download npv and xirr calculator excel template. Take a look at your cash flow, or what goes into and what goes out of your business. I do this by sharing videos, tips, examples and downloads on this website.

The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. Npv irr calculator excel template | irr excel spreadsheet microsoft excel home > excel templates > accounting and finance excel templates > npv and irr. Positive cash flow is the measure of cash coming in (sales, earned interest,.

My aim is to make you awesome in excel & power bi. Calculates the net present value of an investment by using a discount rate. It is important to understand.

The formula used for the calculation is: The npv formula is: Thank you so much for visiting.

Cft = the cash flow in period t, r = the discount rate. It is used to determine the profitability you. =npv(b2,b3:b6) the net present value of the business calculated through excel npv function is.